With the spread of the novel coronavirus, understanding how consumer behavior is shifting, and what brands can do to stay top-of-mind is crucial. We’re breaking down the data on how consumer behavior is changing, from media consumption to purchasing behavior during COVID-19. Plus, we examine whether you should be advertising right now. We’ll also be delivering weekly updates on trends and market changes as new ideas and solutions surface, and look forward to answering your questions around any topics that help us succeed together.

Consumer Reaction

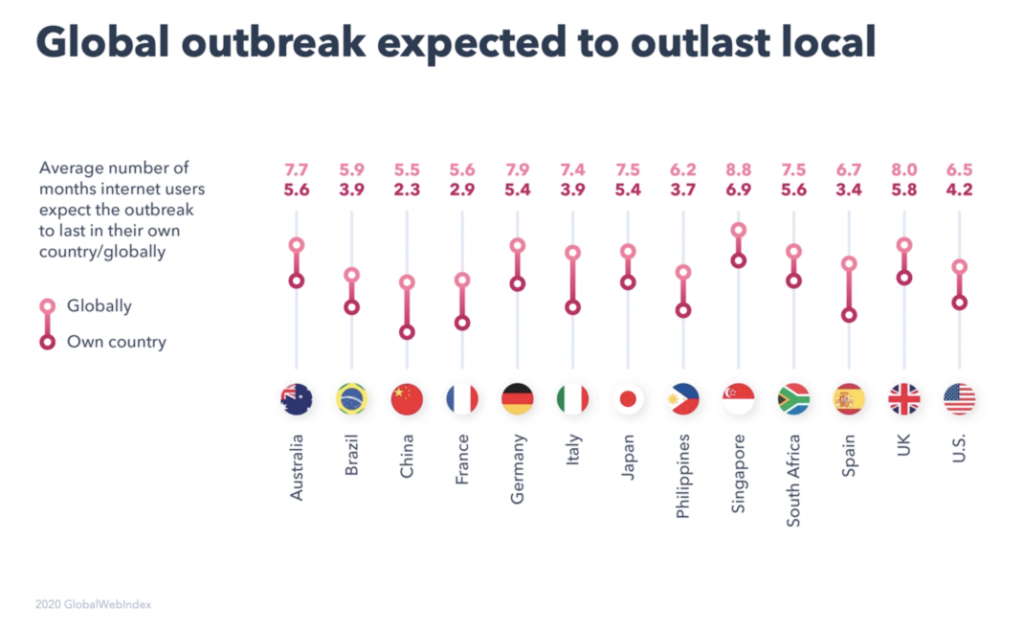

In the United States, the expected length of the outbreak is around four months. However, this will likely be impacted by our current position in the curve, with cases steadily rising and the lack of information around true cases from a deficiency in testing.

Globally, folks in the United States believe that the outbreak will last around six months. Currently, there’s still a reluctance to stay home despite evidence that doing so will slow and minimize the impact of the outbreak. With only 49% of US consumers inclined to stay home, this may be an opportunity for businesses to continue to share social distancing and shelter in place best practices as the outbreak takes hold in areas with less strict government regulation. Another nugget of info? Middle-income and higher income folks are the most resistant to the current situation. This correlates with them being less anxious about the impact on their own economic futures.

Gen Z, Millennials, and Boomers are all reacting differently. Gen Z is particularly altruistic. In keeping with their general attitudes, they’re focusing on making small daily changes that help everyone. Millennials are… stockpiling out of self interest by and large, and Baby Boomers are choosing to isolate to protect themselves. As always, there are exceptions to this rule and things change daily.

We were also intrigued by data around how folks are responding to the idea of a “lockdown” on movement. About 40% believe that folks in highly affected areas should be in lockdown, while 30% believe everyone should be locked down at home and should leave their homes for essential services only. The final third believes no one should be “locked down,” but high-risk groups such as the elderly should self-isolate for their own protection.

Media Consumption

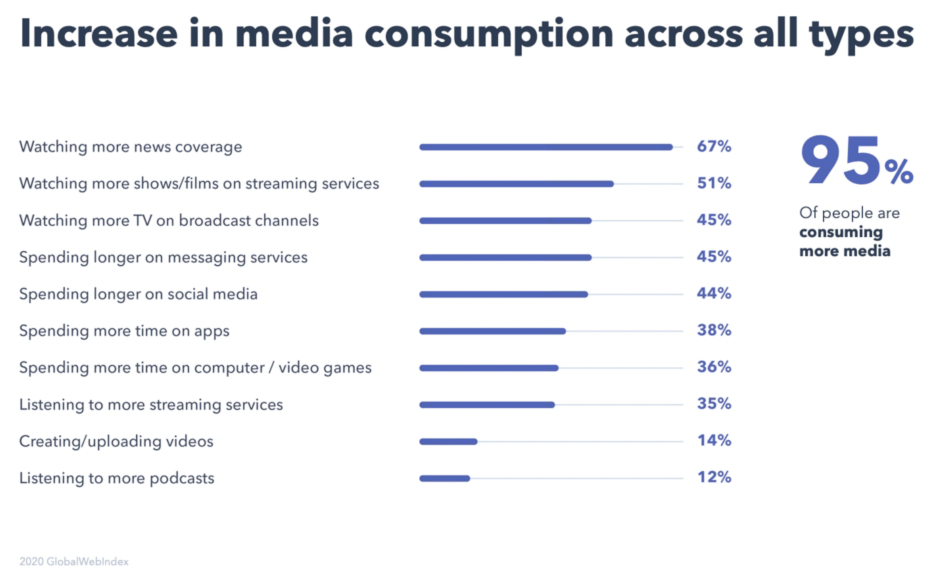

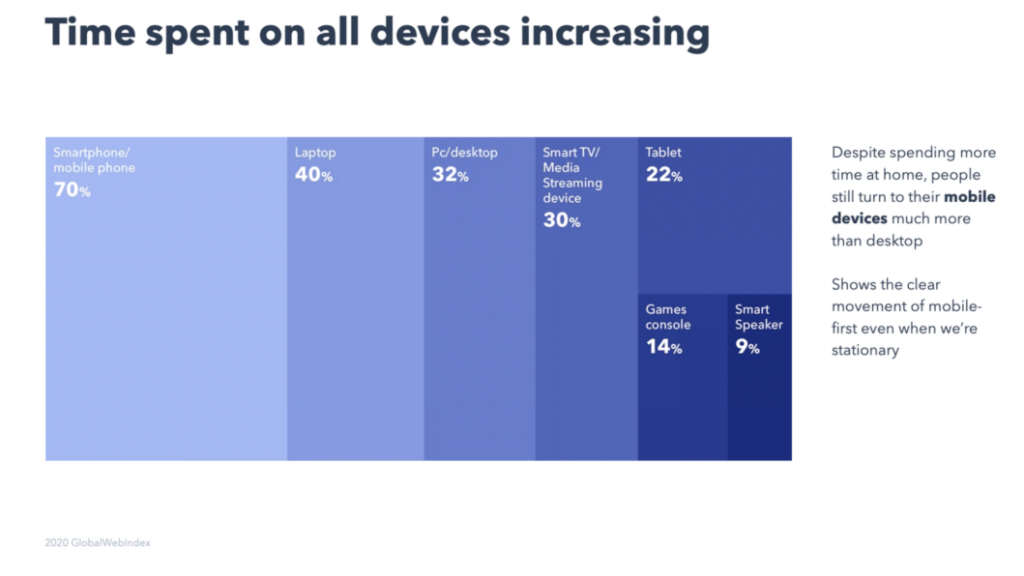

95% of consumers across markets are consuming more media. It’s notable that folks are spending more time on messaging, watching streaming content, and social media. In fact, 50% of people are watching more broadcast television currently. This is also consistent across all age groups.

Parents are also, naturally, looking for more entertainment media–especially on tablets. Folks are also spending more time generating content themselves, with 22% more folks posting videos to TikTok and YouTube. This is true of younger folks, as well as parents of young children, as they try to stay entertained. This is mirrored by celebrities as well. Plus, we’re seeing all kinds of changes on social media in terms of entertainment.

Social media is also becoming a more significant resource for people looking for a way to connect professionally. Business decision makers and folks using the internet for business resources and networking are between 15% and 28% more likely to be spending time online for professional reasons.

Purchase Changes with Coronavirus

The fastest changing purchases? Stockpiling food and household supplies. Younger people are more likely to do this, and the culture of buying in bulk in the US is a likely influence. Nearly half of people are buying more.

Access to accurate information impacts the positive and negative outlooks from consumers. Understanding how access is impacting consumers is critical, as a lack of goods and services may make folks feel more vulnerable.

Another fact? 70% of consumers are delaying purchasing big ticket items like vacations and flights. However, only 15% are delaying home appliances and devices, such as televisions and home decor. Consumers do plan, however, to return to normal once the outbreak is over in their countries. Looking at China’s response shows us a model for redirecting resources and then preparing detailed recovery planning to jump back into growth as we move through the pandemic.

Strong communication efforts are crucial for success here. Brands must also understand how to connect with consumers through this uncertain time.

What Brands Can Do

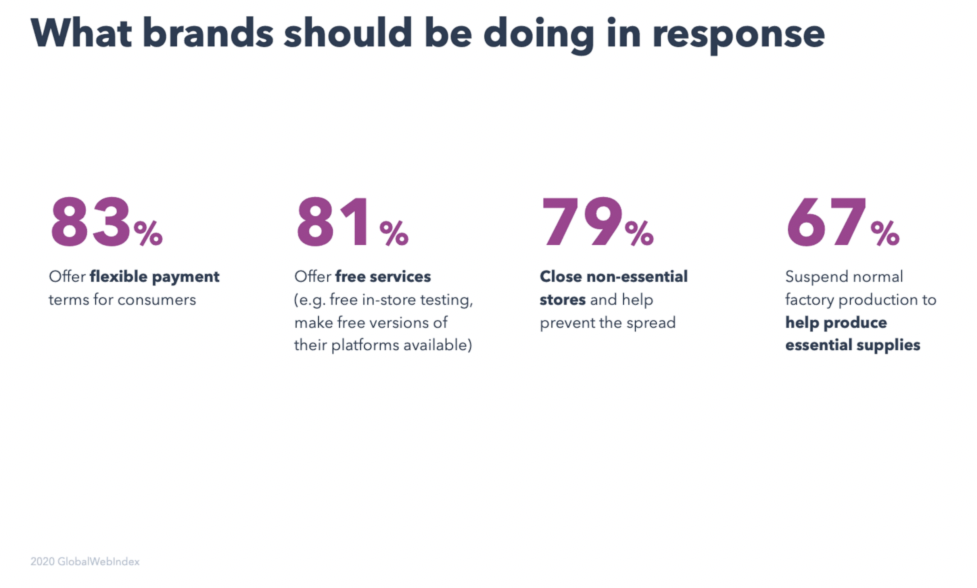

Your consumers want you to help with producing essential supplies, if possible. Flexible payment options, free services, and closing non-essential stores to prevent the spread of disease are consumers’ top priority at the moment. Services like Afterpay or free trials are a great option if you’re able to enhance them.

Building brand affinity through supporting our everyday lives is crucial right now. However, continuing to advertise is a delicate balance. The good news? Most consumers are either apathetic or positive. Less than 30% think brands should stop advertising. In the United States, in fact, 37.5% of consumers agree or strongly agree that brands should continue advertising. This percentage rises when considering urban context. 43.3% of urban consumers believe advertising should continue as usual, and 36.4% of suburban audiences.

However, market nuances are important, so noting how your consumers are reacting individually may assist you through the current pandemic. It’s also notable that folks in Italy tend to be positive about advertising overall, as they reach the crux of their curve of the outbreak there. Thinking about that may help us understand how folks are reacting to what they’re experiencing as they see the light at the end of the tunnel as they want to return to a sense of normalcy again.

Thanks to our partners at GWI for providing the stats provided throughout this blog.